All Categories

Featured

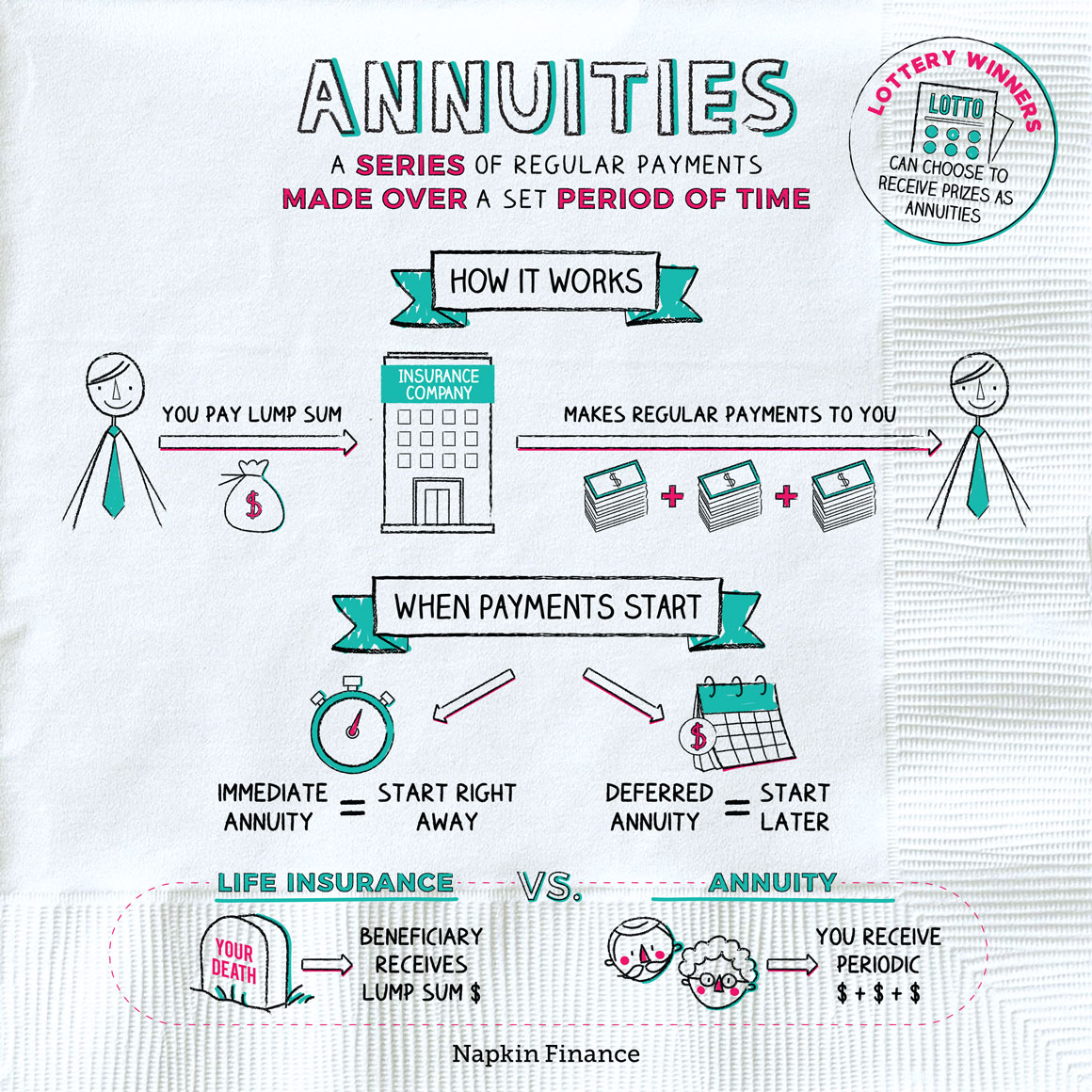

The most effective choice for any type of individual need to be based upon their current scenarios, tax obligation situation, and financial objectives. Annuity contracts. The cash from an inherited annuity can be paid out as a single lump amount, which becomes taxable in the year it is obtained - Annuity contracts. The drawback to this choice is that the profits in the contract are distributed first, which are exhausted as common earnings

If you don't have a prompt requirement for the cash money from an acquired annuity, you could pick to roll it into an additional annuity you control. Via a 1035 exchange, you can guide the life insurance firm to transfer the cash from your acquired annuity into a brand-new annuity you develop. If the inherited annuity was initially developed inside an Individual retirement account, you could exchange it for a certified annuity inside your very own Individual retirement account.

Nonetheless, it is typically best to do so as soon as feasible. This will ensure that the settlements are received quickly which any problems can be managed quickly. Annuity beneficiaries can be contested under certain conditions, such as disputes over the credibility of the beneficiary designation or claims of unnecessary impact. Speak with attorneys for support

in opposed recipient situations (Long-term annuities). An annuity survivor benefit pays a collection total up to your recipients when you die. This is various from life insurance coverage, which pays out a death advantage based upon the stated value of your plan. With an annuity, you are basically buying your very own life, and the survivor benefit is indicated to cover any kind of outstanding prices or financial obligations you might have. Beneficiaries get payments for the term defined in the annuity agreement, which could be a fixed period or forever. The duration for moneying in an annuity differs, but it often drops in between 1 and 10 years, depending on agreement terms and state regulations. If a recipient is crippled, a guardian or a person with power of lawyer will manage and obtain the annuity settlements on their part. Joint and recipient annuities are the 2 sorts of annuities that can avoid probate.

Latest Posts

Breaking Down Your Investment Choices A Closer Look at Variable Vs Fixed Annuities What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Variable Annuities Vs Fixed Annuit

Decoding How Investment Plans Work Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Fixed Vs Variable Annuity Pros Cons Why Choosing t

Analyzing Strategic Retirement Planning Everything You Need to Know About Fixed Indexed Annuity Vs Market-variable Annuity What Is What Is A Variable Annuity Vs A Fixed Annuity? Features of Annuity Fi

More

Latest Posts